Consolidated Financial Statement

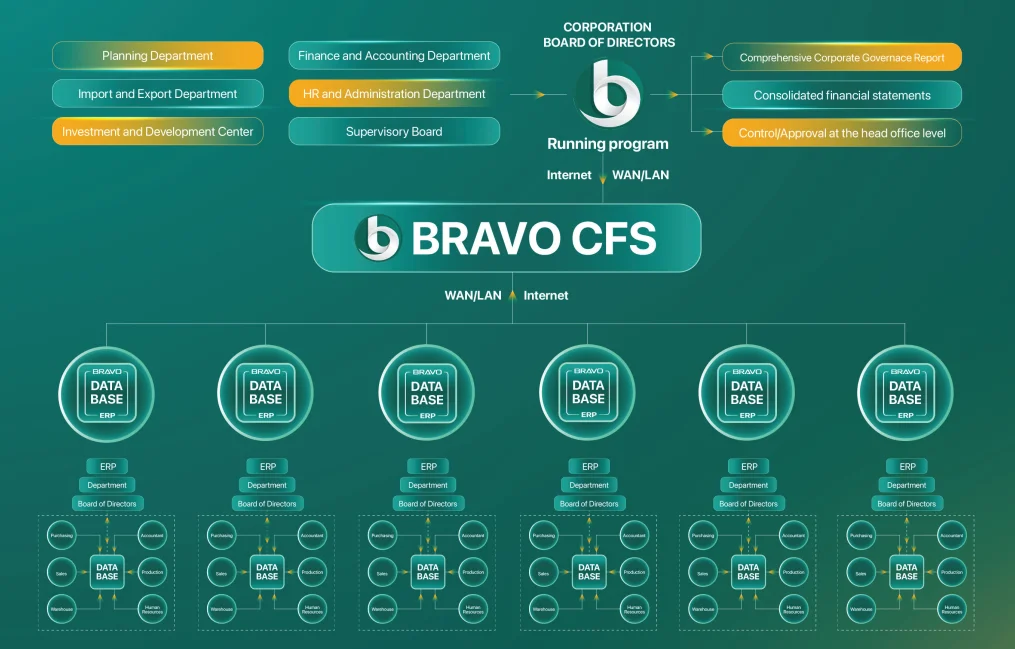

The BRAVO Consolidation Solution (CFS) is a comprehensive overview of the financial situation and business operations of the corporation/group (including the parent company and its subsidiaries, joint ventures, and affiliates within the shared ecosystem).

Overview

The BRAVO Consolidation Solution (CFS) is a comprehensive overview of the financial situation and business operations of the corporation/group (including the parent company and its subsidiaries, joint ventures, and affiliates within the shared ecosystem). Financial data consolidation helps leaders, investors, and stakeholders measure the overall health of the entire system, evaluate performance, manage risks, and make strategic decisions for the entire Corporation/Group.

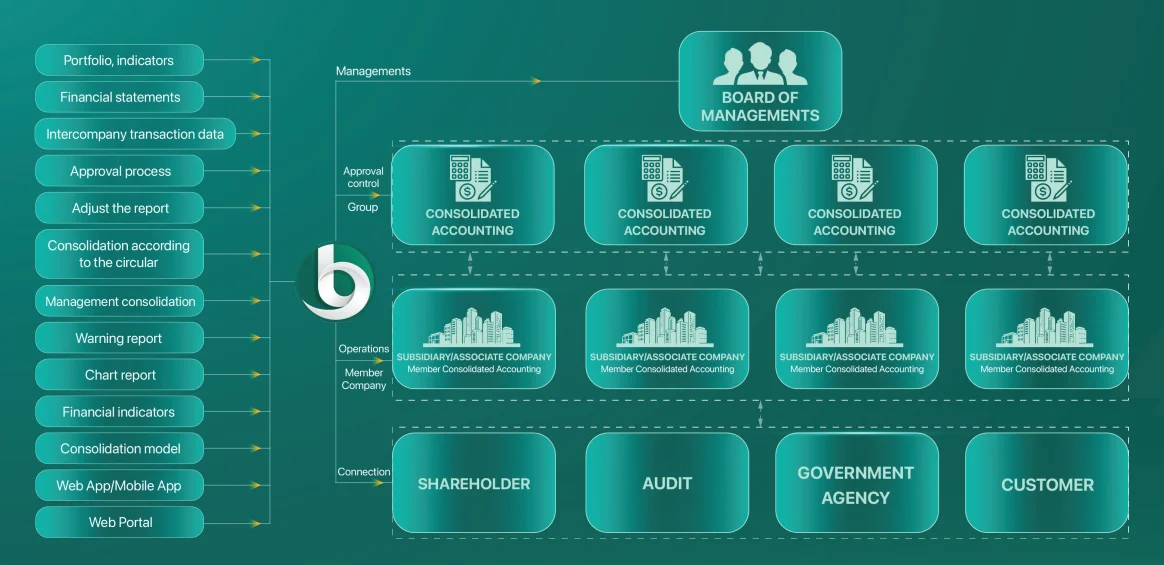

Management Process

(1) Data collection: Collect member unit data and approve (Financial reports, management internal data)

(2) Approval process: Process of controlling and approving data of member units. Funcition of warning data indicators to serve consolidation support at Member Units

(3) Get consolidated data: Receive reporting data of subsidiaries and affiliates after the approved process. Warning of incorrect indicators on the software.

(4) Exclusion of insider trading: The problem is to eliminate internal transactions between member units in the group (Inventory transactions, fixed assets, loan transactions...).

(5) Adjustment,periodic entrance: Adjusting internal transactions and periodic entries (provisions, investments, goodwill allocation, non-controlling interests, etc.).

(6) Preparation of consolidated reports: Prepare consolidated financial statements (Economic balance sheet, Business results, Cash flow, Financial statement notes, Management reports as required...).

BOARD OF DIRECTORS: As the management and decision-making layer, the BRAVO 10 financial consolidation solution (CFS) uses the Dashboard BI tool and the analytical data system, which are financial reports (Consolidated balance sheet, consolidated business results, consolidated cash flow statements, etc.), transaction data sets and exclusion indicators (Inventory, asset purchases and sales, internal transactions, commercial advantages, EPS/Diluted EPS, etc.), corporate governance reports (Analytical indicators on loans, cash flow, revenue, costs, output, ROA, ROE, ROS, etc.). Implement information disclosure, make decisions/assign tasks quickly and effectively in business management and operations.

Main features

CONSOLIDATED ACCOUNTING OF MEMBERS

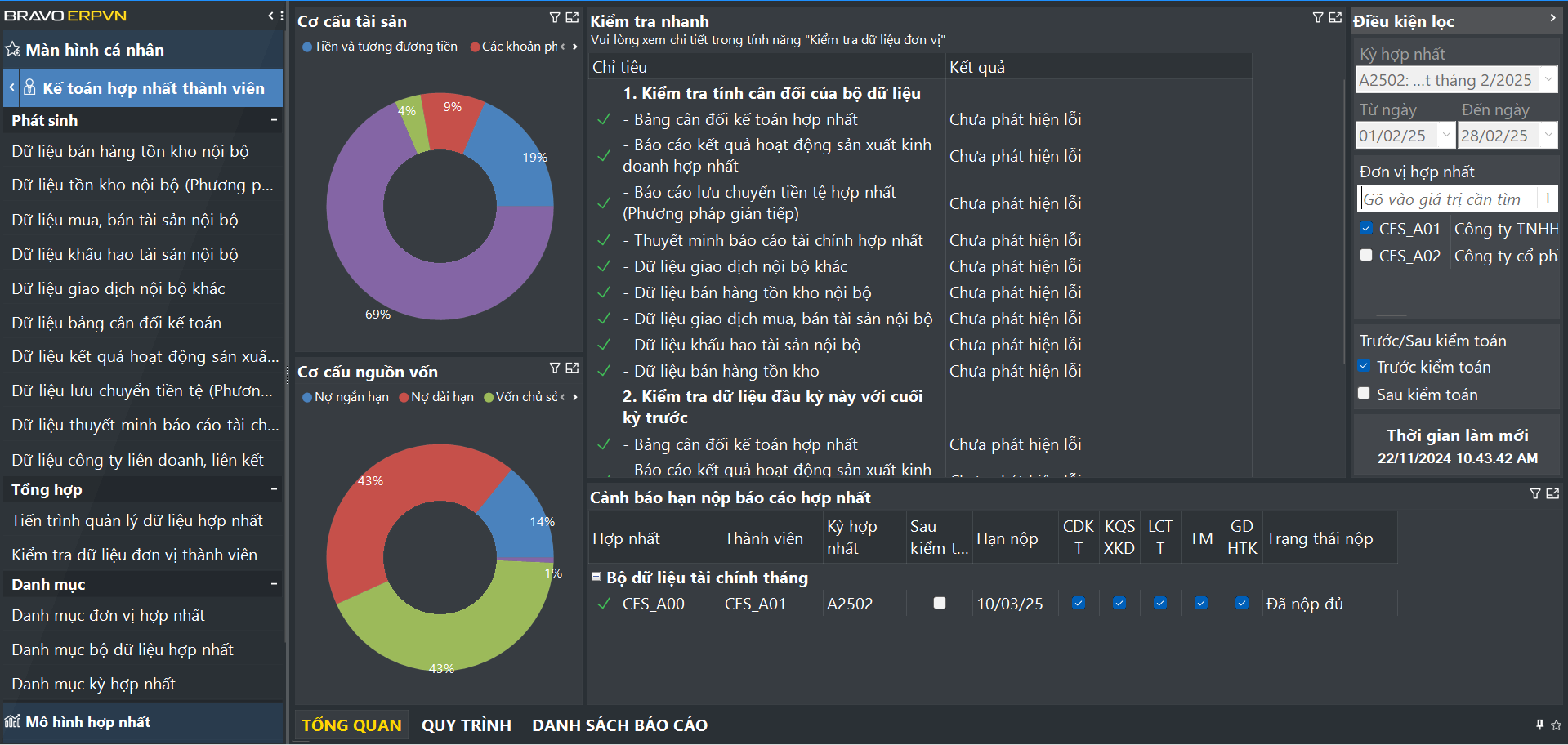

Consolidated Accounting Members Interface

GROUP CONSOLIDATED ACCOUNTING

This is the layer that performs the work of approving and controlling data of member units in the system. The role function is the person responsible for approving/receiving consolidated reports/data of units according to the declaration process, controlling and implementing adjustments/standardizing data and consolidating financial reports of the entire system.

This is the direct operational layer that provides all data to prepare for the consolidation of group/corporation data. The detailed role function will perform and prepare, review the data of member units (List, set of indicators, set of financial reports, internal data set as required...). Use the system functions (Data warning function, reporting function...) to check the correctness of the data set sent for consolidation at the unit and perform the function of sending/transmitting reports/data to the consolidation software on the Group/Corporation before performing the next processes on the consolidation software.

Group Consolidated Accounting Interface